Flightlines 13: Frontier's Push For ULCC Dominance

An evaluation of Frontier's claim to be the future leader of ultra-low-cost air travel.

300000Z SEP 24

Good morning, and welcome to Flightlines!

In this issue, we examine the ultra-low-cost carrier (ULCC) market in America. During their Q2 earnings call, Frontier Airlines boldly claimed they would "be the clear low-cost winner in 2025 and beyond."

This statement prompted us to investigate: Who currently holds the title of "low-cost winner," and what would Frontier need to do to claim this position in the coming years? This week's feature analyzes recent earnings reports from leading ULCCs and attempts to answer these questions.

In this issue of Flightlines:

✈️ Feature: Frontier's Push For ULCC Dominance

📍Routes of note

Delta Airlines is launching a new route from Salt Lake City to Seoul in June 2025.

Icelandair will test a new route from Reykjavik to Nashville in mid-May 2025.

China Southern Airlines is extending service from Guangzhou to Belgrade through late March 2025.

Cathay Pacific will offer service from Hong Kong to Dallas in April 2025.

🗞️ In the news

Emirates' first Airbus A350-900 completes maiden flight in Toulouse.

Ryanair plans increased flights in Sweden following the removal of aviation taxes.

SAS A350 struck by lightning during departure from Copenhagen to Shanghai.

Air France to offer free Starlink high-speed internet starting in 2025.

Feature

Frontier’s Push For ULCC Dominance

Budget air travel in America is a battleground where mere cents can mean the difference between profit and loss. Operating on razor-thin margins, airlines offer a product that is essentially a commodity, while managing assets that can be worth upwards of $100 million each.

This balancing act, coupled with the enduring wonder of flight, makes ultra-low-cost carriers (ULCCs) a uniquely dramatic segment of the industry. Few other businesses combine such intense price competition with operational complexity and significant capital investment. The result is a sector ripe for analysis, where strategic decisions and market forces unfold under constant pressure, providing a true test of business leaders' management skills and effectiveness.

In the American market, several ULCCs operate, including Frontier, Spirit, Allegiant, Sun Country, Breeze, and Avelo. Sun Country is a smaller airline with a hybrid model that combines low-cost routes and charter services. Breeze and Avelo are newer entrants, still developing their route concepts, but both have shown effectiveness and future potential.

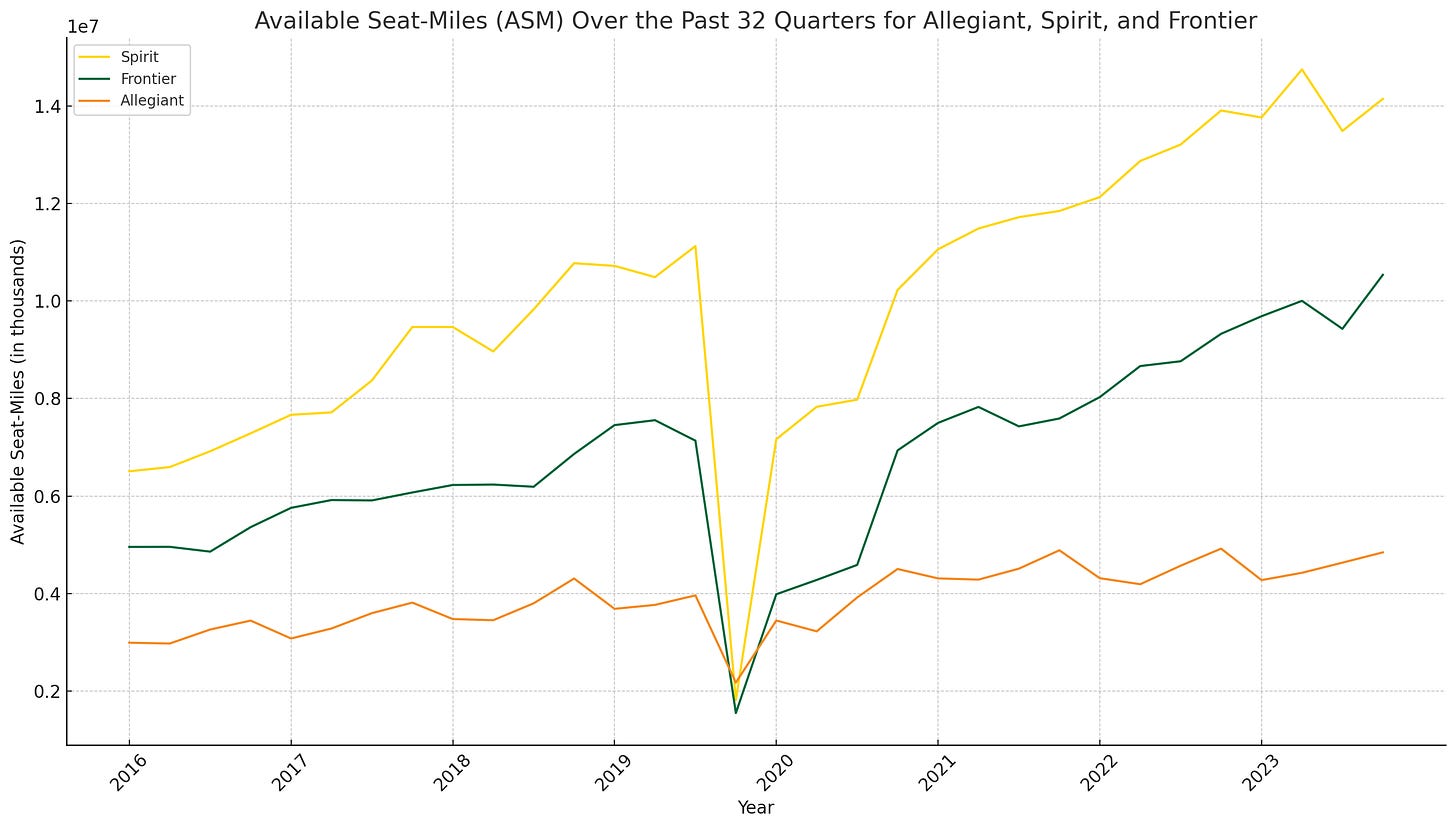

Our analysis will focus on Frontier, Spirit, and Allegiant, as they are the current market leaders. We begin by examining the size of these carriers' networks. Available Seat Miles (ASM) measures an airline's passenger-carrying capacity, representing the total number of seats available for sale multiplied by the distance flown. ASM will help us quantify each airline's capacity.

Spirit leads in terms of ASM, indicating the largest capacity among the three airlines. Frontier follows closely, while Allegiant has taken a more measured approach to growth, consistent with its focus on underserved and leisure markets. If Frontier continues to grow its ASM at a faster pace than Spirit, it would indicate an expansion in fleet and network capacity, allowing Frontier to capture more market share.

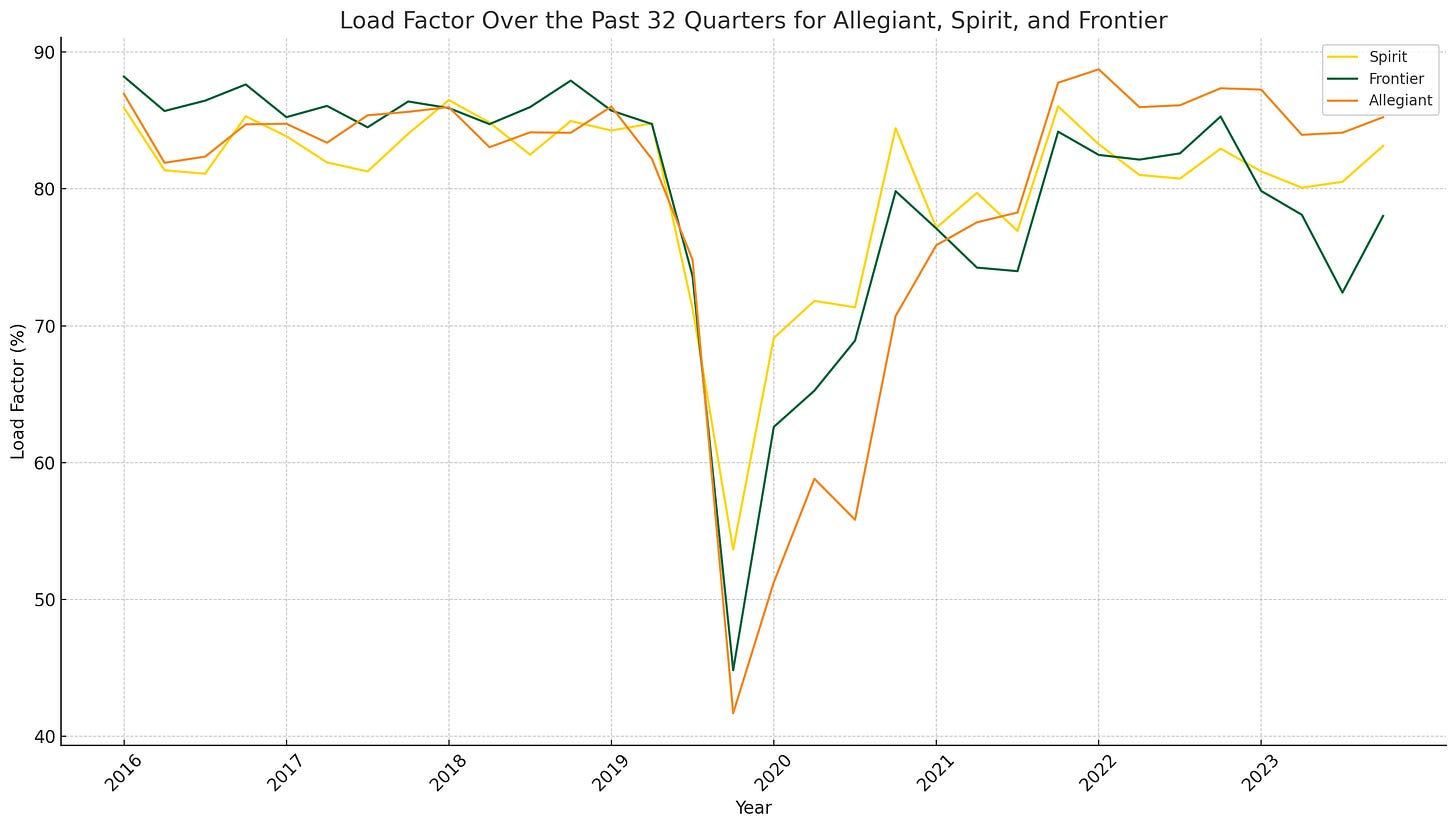

However, analyzing capacity alone is not enough to crown a low-cost winner as utilization is more key to efficient growth. Load Factor measures the percentage of available seats that are actually filled with passengers. It is calculated by dividing Revenue Passenger Miles (RPM) by ASM. A higher load factor indicates that more of the available seats are being occupied, demonstrating the airline's ability to match capacity to demand effectively.

Allegiant's focus on leisure travel and careful route choices have given it an advantage in filling seats since the pandemic. Frontier has also done well by staying flexible and adjusting its routes to meet demand. Spirit's recovery has been strong, but it still faces challenges competing with other budget airlines and managing its larger network.

While load factor is a valuable indicator of how effectively an airline is utilizing its available capacity, it is only part of the story when evaluating financial success. A high load factor helps airlines spread costs across more passengers, improving efficiency, but it doesn’t directly account for profitability. To understand how efficiently an airline translates full flights into profit, we must look at income.

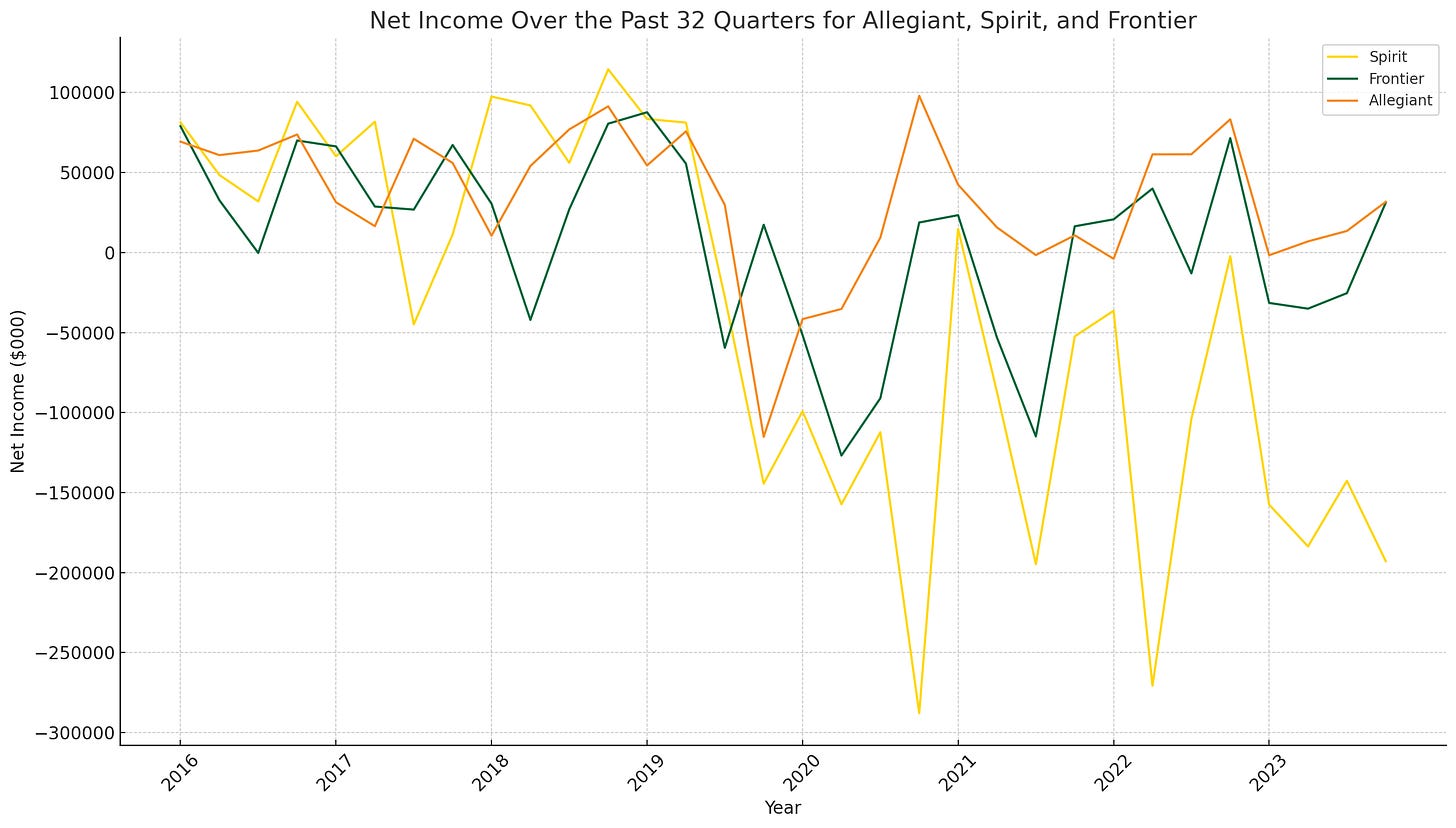

Net income provides insight into the bottom line—how much profit remains after all expenses are accounted for, including operational costs, fuel, and labor. Even with a high load factor, net income can vary depending on factors like pricing strategy and operational efficiency. For instance, maintaining a high load factor through low fares might boost passenger volume but could pressure profitability if costs are not well-managed.

The net income chart for Allegiant, Spirit, and Frontier over the past few years reveals interesting insights into each airline's financial performance. Spirit's aggressive growth strategy, while effective at expanding market presence, comes with challenges in maintaining consistent profitability. Frontier, in contrast, appears to maintain more stable and generally higher net income. Allegiant consistently shows positive net income across most of the quarters, which is impressive, especially compared to the more erratic patterns of Spirit and Frontier.

Allegiant's success likely stems from its focus on leisure routes and small markets, allowing it to avoid direct competition with larger carriers. By sticking to a carefully curated network, Allegiant is able to maintain steady profitability without the pressures that come with rapid expansion or intense competition.

Allegiant’s business model, which also generates revenue from ancillary services like vacation packages, helps stabilize its financial performance. In comparison, Spirit and Frontier are more susceptible to swings in net income due to their aggressive growth strategies, which involve adding more routes and flights, often in competitive markets.

Frontier, Spirit, and Allegiant each bring unique strengths to the ultra-low-cost carrier segment, but their differing approaches lead to distinct outcomes. Spirit, while the largest in terms of capacity, faces challenges in maintaining consistent profitability. Its aggressive growth strategy has expanded its market presence, but this has come at the cost of higher volatility.

Allegiant, on the other hand, has carved out a profitable niche by focusing on leisure routes and secondary airports. While perhaps more disciplined, Allegiant’s growth is inherently limited compared to its more aggressive competitors.

Ultimately, the balance struck between profitability and growth seems to have positioned Frontier to lead the ULCC segment in the long term. It has managed to expand while keeping costs under control, and has demonstrated an ability to adapt to changing demand. Allegiant’s steady, smaller-scale success and Spirit’s market presence are both impressive, but Frontier’s combination of growth and stability gives it the upper hand.

Although Frontier has crowned itself the "low-cost winner," we believe this title is both valid and even deserved. The coming years will reveal which airlines have the discipline and innovative capacity to succeed in this competitive market. We will certainly be watching closely. ✈

PS: How many ears does Daniel Boone have?

A right ear, a left ear, and a [suddenly musical] Front-ier! 😆 Frontier. Get it?

Let's explore this week's noteworthy events that are shaping the future of air travel.

Routes of note

The most significant new routes and service changes this week, offering insight into strategic expansions and market shifts.

🇺🇸 Salt Lake City (SLC) – 🇰🇷 Seoul (ICN) via Delta Airlines, June 2025

Delta Airlines is expanding its transpacific network with this new route connecting Salt Lake City to Seoul. This addition solidifies Salt Lake City's role as an international hub and enhances U.S.-Asia connectivity, catering to both business and leisure travel demands.🇮🇸 Reykjavik (KEF) – 🇺🇸 Nashville (BNA) via Icelandair, mid-May 2025

Icelandair is launching a new route from Reykjavik to Nashville, marking its expansion into the southern U.S. market. This route strengthens transatlantic connectivity and taps into Nashville's growing popularity as a business and tourism destination.🇨🇳 Guangzhou (CAN) – 🇷🇸 Belgrade (BEG) via China Southern Airlines, March 2025

China Southern Airlines is extending its service from Guangzhou to Belgrade, emphasizing its commitment to expanding into Eastern Europe. This route fosters stronger economic and cultural ties between China and the Balkan region, providing a direct link for tourism and trade.🇭🇰 Hong Kong (HKG) – 🇺🇸 Dallas (DFW) via Cathay Pacific, April 2025

Cathay Pacific is launching a new route from Hong Kong to Dallas, adding a key connection between Asia and the southern United States. This route signifies Cathay Pacific's ongoing recovery post-pandemic and strengthens its long-haul transpacific offerings.

In the news

The latest and most impactful stories shaping the world of commercial aviation this week.

SEPTEMBER 25TH, 2024

Emirates’ First Airbus A350-900 Completes Its Maiden Flight - AirGuide

Ryanair launches more routes from Sweden as aviation tax scrapped - Reuters

SEPTEMBER 26TH, 2024

Scandinavian Airlines A350 suffers lightning strike departing from Copenhagen - AeroTime

Air France to Equip Entire Fleet With Free Starlink Wi-Fi - Airline Geeks

SEPTEMBER 27TH, 2024

Italian Airline Neos Strikes Partnership With New Terminal One For Operations At New York JFK Airport - Simple Flying

SEPTEMBER 28TH, 2024

Tug Catches Fire While Pulling American Airlines Boeing 787-9 Dreamliner In São Paulo - Simple Flying

Lufthansa Axes Frankfurt To Beijing Route Due To High Costs & Weakening Competitiveness - Simple Flying

✈

Thank you for reading.

Flightlines will be back next week with more insights and updates from the world of commercial aviation.

Until then, safe travels and happy flying!

Fascinating write up on ULCC’s. It has been a few years since I was a regular flyer for business, but our choice in carrier was always price motivated. In those times several years ago, we flew Southwest as the least expensive option. First question is what does Southwest do to not qualify as a ULCC? Last question is their change in seating policy changing them to a more expensive middle of the road carrier? Open seating was initially scary but became a comfort- one less thing to pre-plan for. I would appreciate your thoughts. I vividly remember flying from Baltimore to Seattle with no meals- just a bag of peanuts… when the other carriers provided cross country lunch.

Impressive research and analysis. I was surprised to see the plummets in the graphs were just before 2020 - unless I'm looking at them wrong, or Americans were more aware of Covid before I was. Also, what a great joke at the end!!